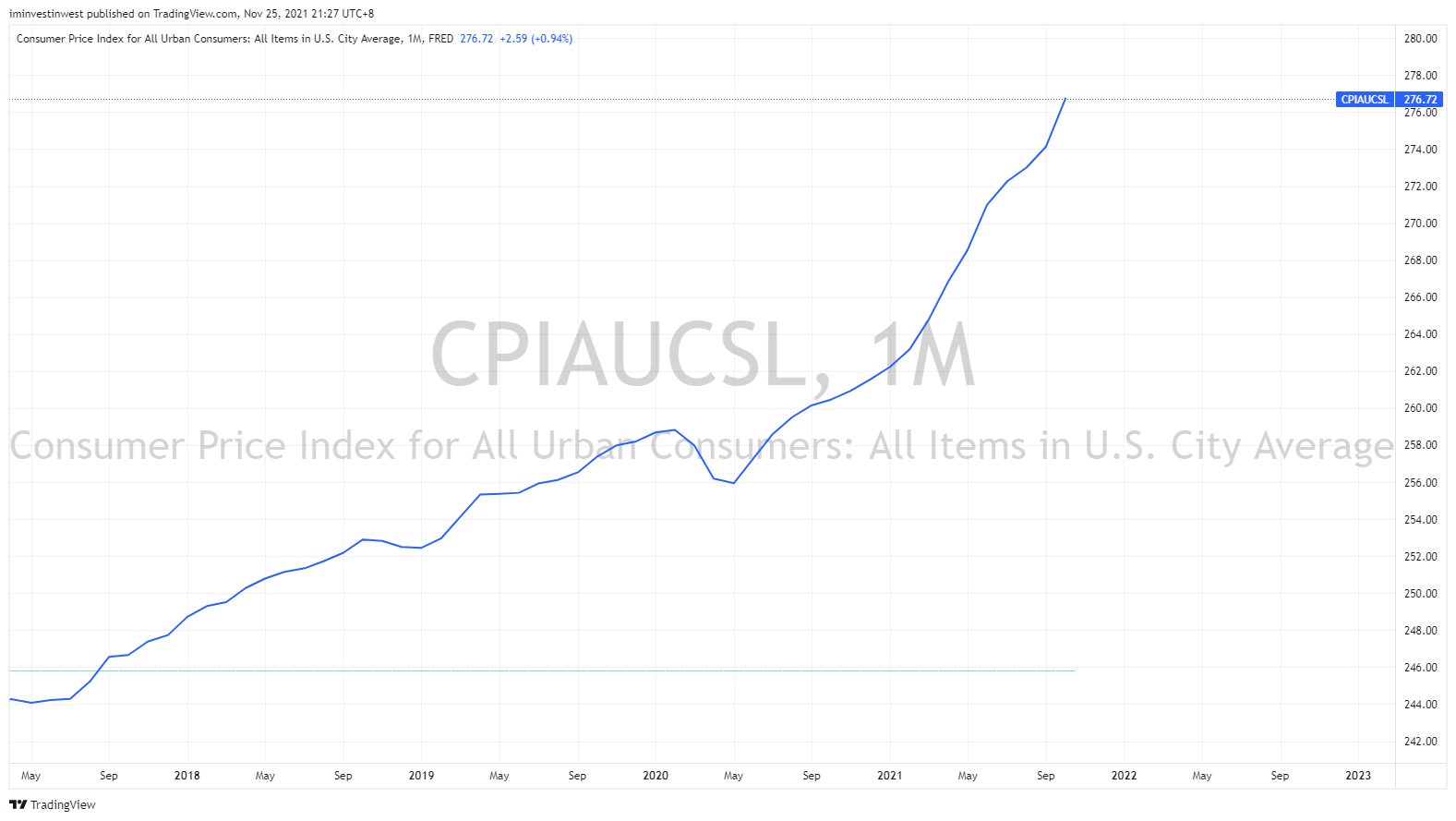

Inflation is a hot topic recently. See below CPI data climbed to new high.

Inflation not only impacts people’s daily life, from food to gasoline, but also hurt stock price (and our investors). Why? The root cause is, high inflation rate reduces the present value of future earnings and dividends.

What to invest in this inflationary environment? In another word, How to “anti inflation”? Here is an answer provided in a “The Economist” article: put money in physical assets. For example, property, infrastructure, gold etc. But, be careful:

- Some of these assets may be exposed to stock market (e.g. REITs) which will be hurt by inflation to certain degree.

- Time has changed. Performance of some assets are no longer easy to predict. (Due to Covid impact, take a look at the poor performance of office REITs, hospitality REITs, airports etc.)

- It’s a known secret, which means, price of these assets may not cheap. For example, the gold price has been on this high level since 2010.