WASHINGTON, Sept 21 (Reuters) – Federal Reserve Chair Jerome Powell vowed on Wednesday that he and his fellow policymakers would “keep at” their battle to beat down inflation, as the U.S. central bank hiked interest rates by three-quarters of a percentage point for a third straight time and signaled that borrowing costs would keep rising this year. (original link of this news: Fed delivers another big rate hike; Powell vows to ‘keep at it’ | Reuters)

The clue is clear: Fed’s concern is inflation. So Fed increases interest rate, to increase the financing cost of the economy, to cool down the economy, to finally bring down the inflation.

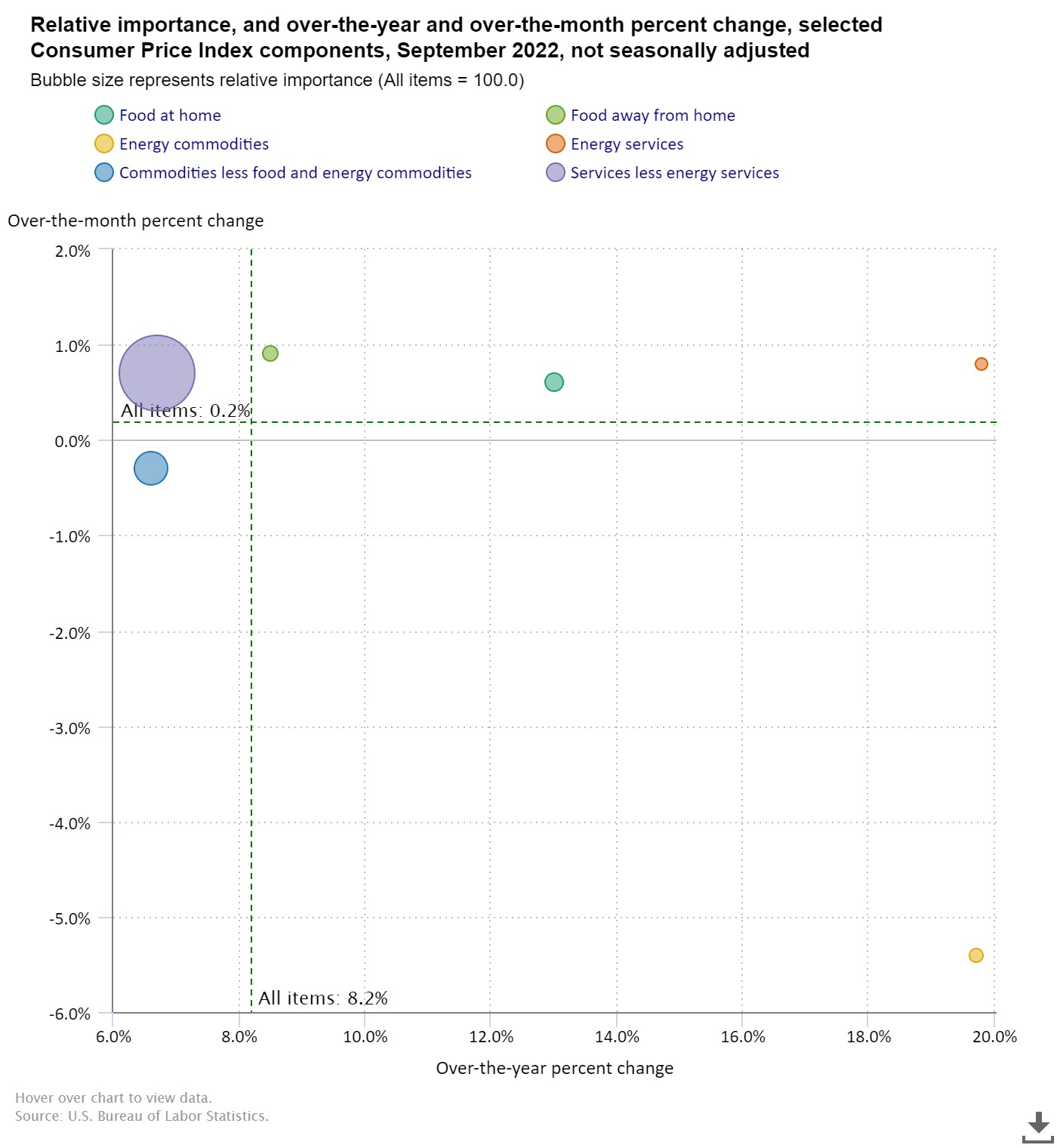

Obviously, inflation (or CPI), is what everyone is monitoring, to predict Fed’s next move. So we need to dig in a bit more. let’s take a look of the chart below (CPI growth by components, Sep 2022). What can we get?

- CPI Sep 2022 yoy at 8.2%, on the high level;

- Energy (commodities & services) go crazy (>18% yoy), however, their importance is relatively small. And, Energy commodities is declining >-5% from Aug’22 to Sep’22. To me, it means energy is less concern now compared with early this year.

- The largest component of CPI is from “Services less energy services”. The bubble is big (contributes 56.8% of total CPI, data not shown in this chart). It grows 6.7% yoy, and grow 0.8% m-o-m. I think this is the biggest concern for Fed.

- This service bubble includes housing and all kinds of other services. To me, it means, besides energy, two other components are also main drivers of this year’s inflation: housing market and labor cost.

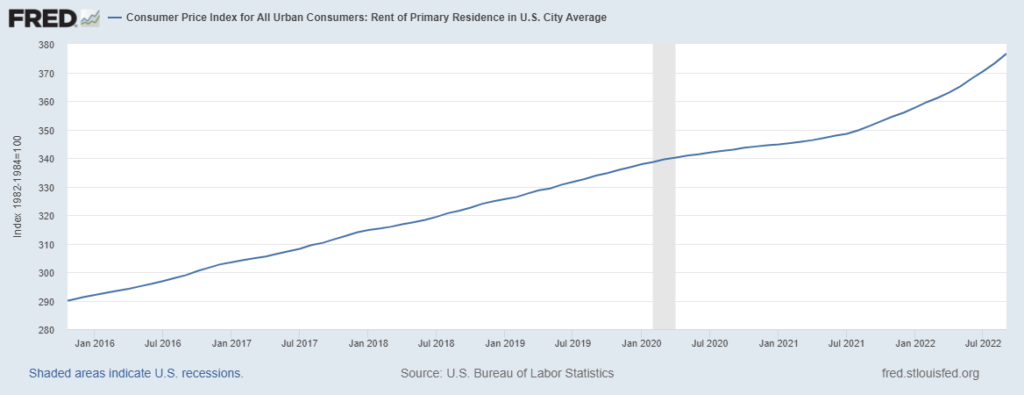

First of all, housing market in US is very hot this year, similar like Singapore. Rental increase significantly. See below chart. As long as economy is good, people can afford rental / mortgage, it will stay solid (U.S. new home sales unexpectedly rise in August | Reuters). This is the situation as of now. We need to monitor the change of housing market, especially with 30 year fix mortgage rate over 7% in US, any trend reversal from housing rental will press down CPI significantly.

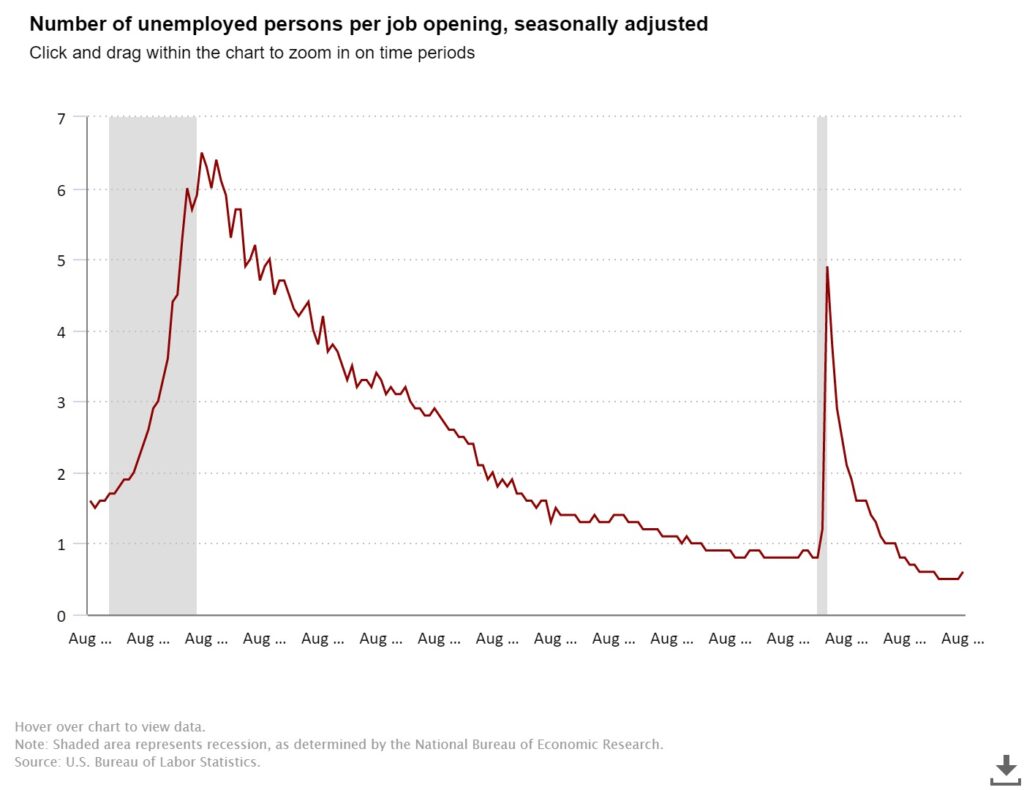

Secondly, labor cost. With recovery from Covid-19 Pandemic, labor market is hot in US. How hot? See below chart. For each job opening, there is only 0.6 unemployed person, which is the lowest level in decades. What does this mean?

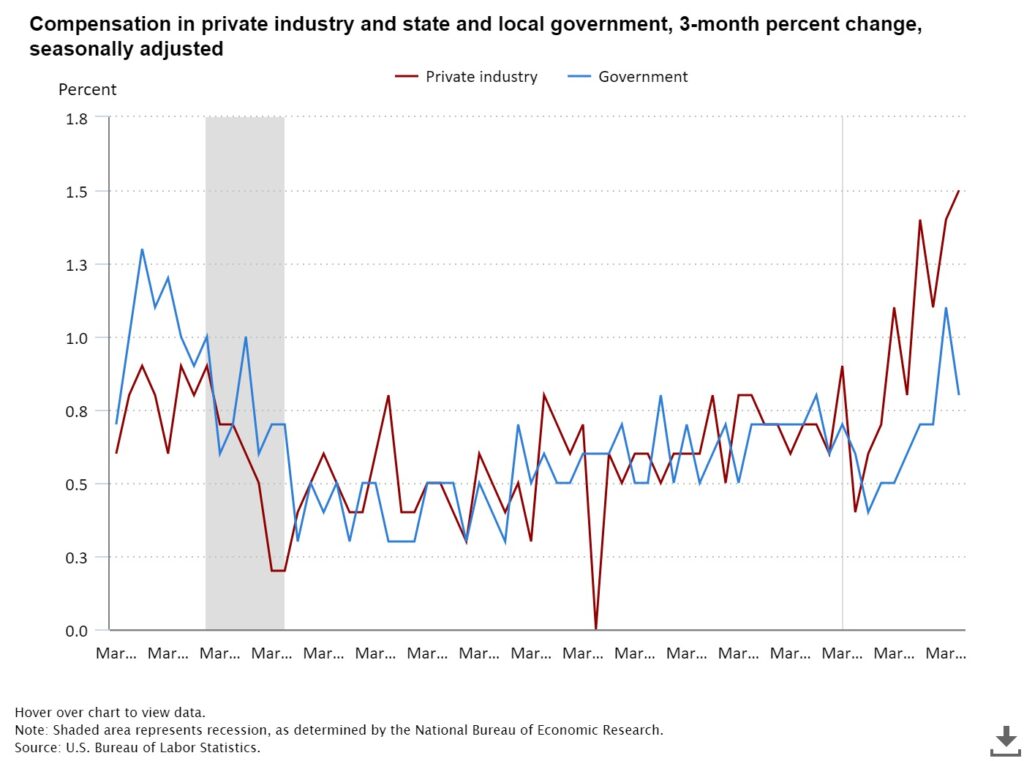

It means employers have to pay higher labor cost to not only to hire new positions, but also to retain their employees. See below chart, the latest private industry compensation (June 2022) change is +1.5%..which is also highest in two decades.

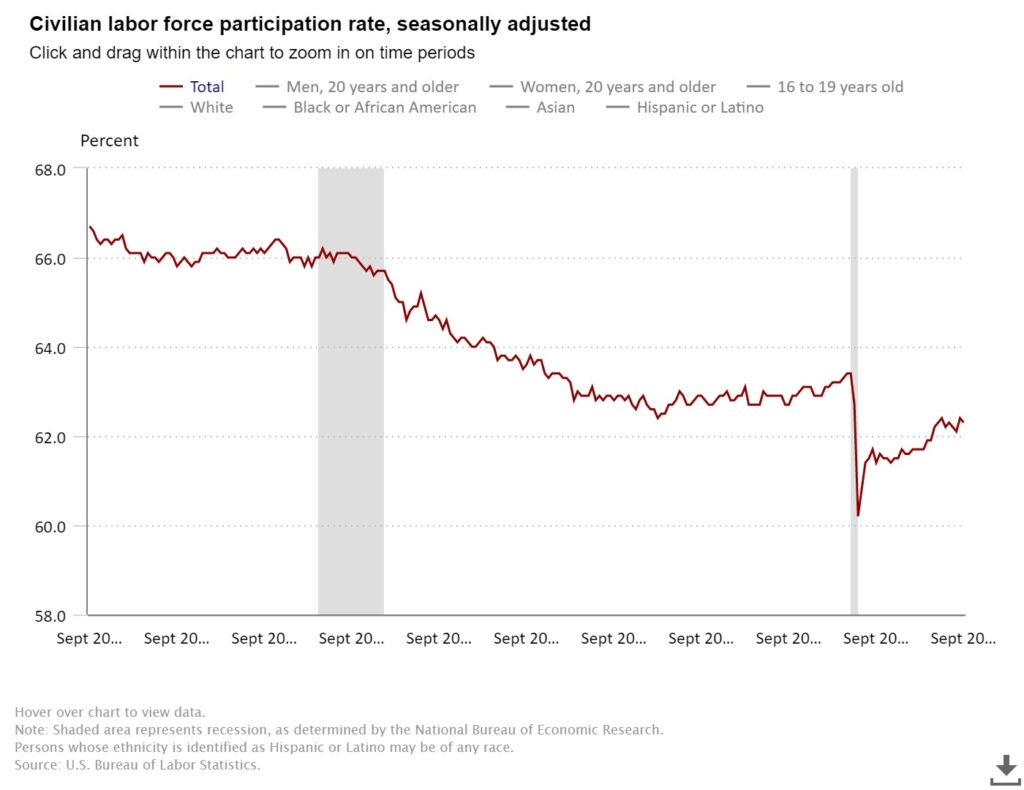

Let us look at labor supply side. US labor participation rate has been going down from 66% level (2006) to 63.4% before Covid (Jan 2020), then to 62.4% as of now(Aug 2022). This means there are fewer workers in the labor supply side now (1% lower vs before Covid).

With labor demand rising and labor supply falling, the labor cost is going north for sure.

But on the good side, labor participation rate is trending up, hopefully gradually the labor supply will recover more (with higher wages now, and with Covid impact is less severe). This is definitely one positive factor to ease the labor cost increase then bring down inflation.

To summarize, housing(rental), job opening per unemployed person, labor participation rate are the main economic indicators that I will monitor in the next few months to guess where Fed is heading. There might be others to be added in the watch list, we will have to find the relevant ones from the latest CPI release.

great analysis