JPY has been a bargain for the past one year plus. Currently JPY/USD is at 134, JPY is on the cheapest level in two decades. My view is now is good time for buy-low-sell-high strategy: buy in JPY-denominated assets at the low price now, then wait for JPY to climb back to normal level and sell.

There are two questions to clarify. 1. Why will JPY climb back? Will JPY depreciate even more? 2. What can we invest?

1. Why will JPY climb back? Will JPY depreciate even more?

a. USD is strong due to interest rate increase. However in the latest meeting, Fed has signalled slow down of interest rate raise and eventually Fed will start to lower interest rate when inflation is under control. This is going to lower USD valuation. In fact, USD index DAX has declined 10% from its peak in 2022, but it is still on highest level since 2002. In the long term, USD is still too strong.

b. Japanese interest rate has reversed from negative to positive. With inflation pressure, JPY interest rate could go higher. This is going to support JPY valuation.

c. To add on, if US or global recession do happen, especially if energy price collapse due to recession, JPY will be more attractive as safe heaven asset, relative to USD, as Japan will benefit from lower crude oil price and should be able to maintain its trade surplus, which will provide strong support to its currency.

Thus, I’m more comfortable betting JPY will be going stronger than going further down.

2. What can we invest?

Besides trade directly in FX market for JPY, for residents in Singapore, Daiwai House Logistics Trust (SGX symbol: DHLU) is a good investment target to gain exposure to JPY.

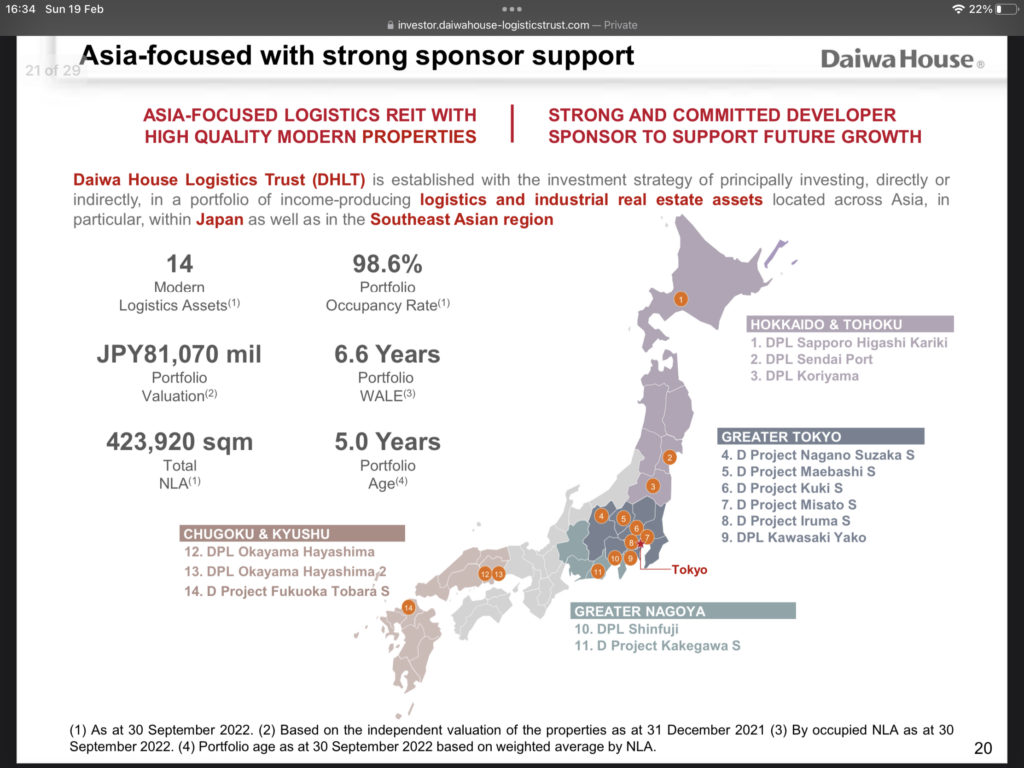

a. It is a REIT with 100% of its portfolio in Japan, so its assets, borrowings, income and costs are 100% JPY denominated. It’s fundamentals are also very strong, with a very strong sponsor to support it.

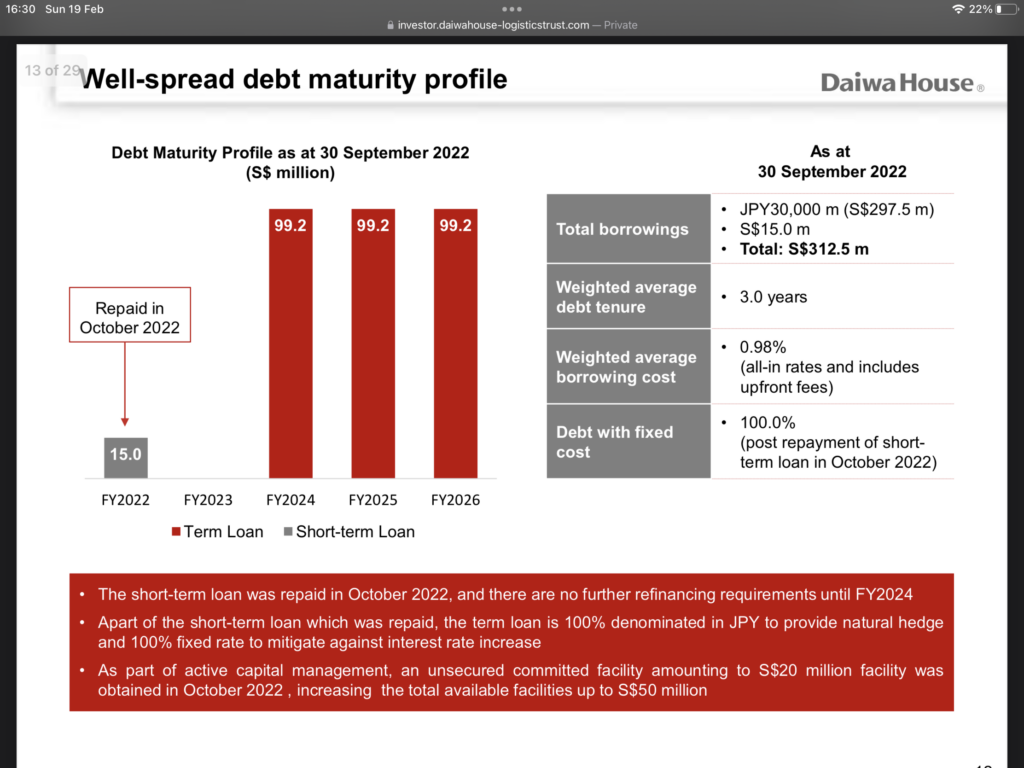

b. It’s debt profile is OK.Refinance will only start in 2024.

c. Net Asset Value (NAV) per unit is S$ 0.765, while current stock price is only S$0.62. This means we buy its assets with a 20% discount.

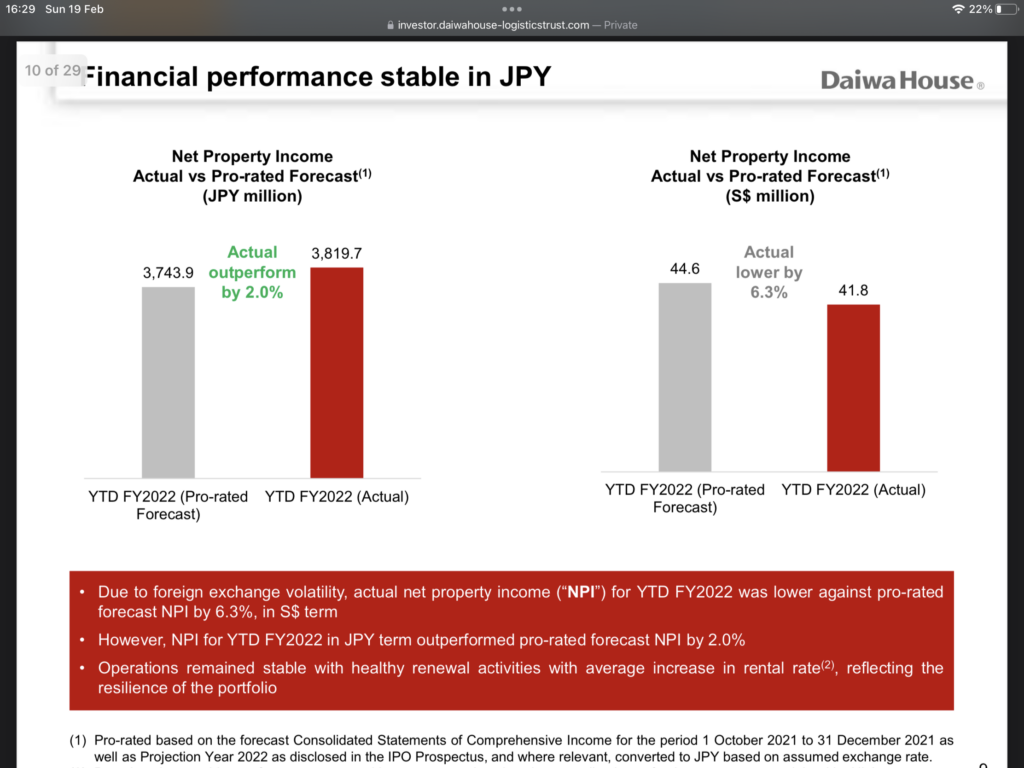

d. Business performance is stable in JPY term, in SGD term it underperform due to the unfavorable FX rate. But this is good for us, because it means the worst has been priced in. Any JPY/USD or JPY/SGD trend reversal will provide additional fx gain to its net income.

e. Dividend yield: about 8%, much higher than risk free JPY interest rate (still negative interest rate for 2 year government bond).

In conclusion, DHLU is a stable REIT business which will be less impacted by a potential recession compared with other investment instruments. Its JPY-denominated assets and income will hedge against USD devaluation / SGD devaluation. And don’t forget 8% dividend yield at current price level. Overall, this REIT provides a very comfortable risk-reward ratio to me.