Continue with the portfolio topic. In a previous post (should you add bonds in your portfolio?), I shared that I don’t like to add bonds in my portfolio, the reason is, bonds don’t provide the diversification to my portfolio. Then what is my choice? Crypto currency.

Let’s be clear. Crypto currency is high risk asset (or high risk trash if you don’t believe it has value). I’m not an expert of Crypto currency. I don’t know how Crypto currency generate value. Then why do I add Crypto currency in my portfolio?

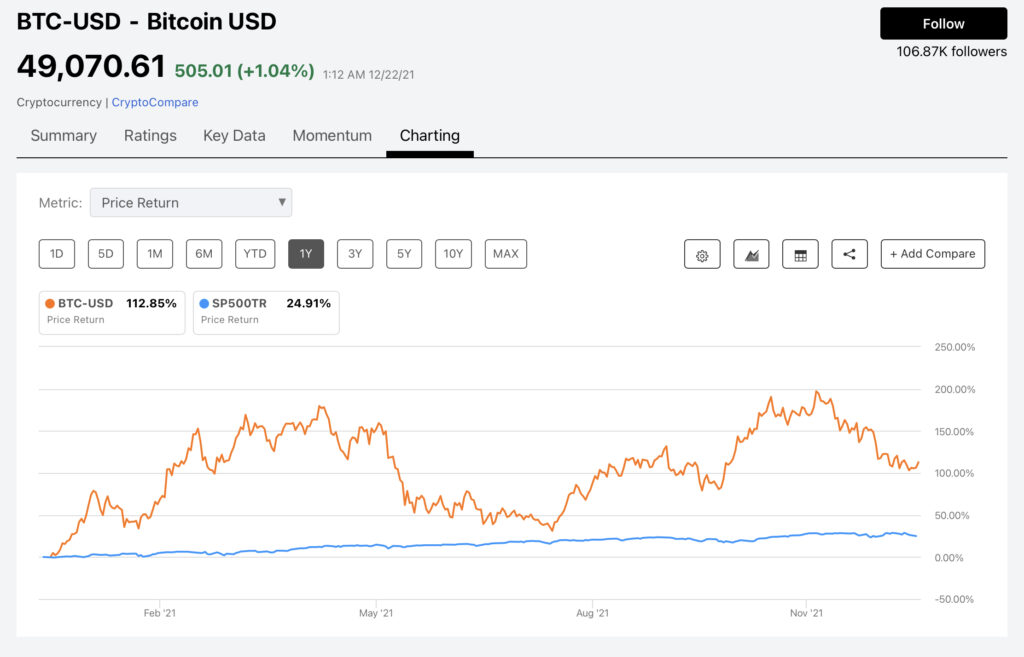

Portfolio is about to maximise return relative to risk. The key here is it’s not necessarily an asset’s own risk that is important to an investor, it is the contribution it makes to the volatility of the overall portfolio. If two assets are highly non-correlated, the overall portfolio may achieve a good diversification (two assets balance out their different swing patterns). See below Bitcoin and S&P 500 one year performance. It’s very clear in the past year Bitcoin and S&P500 swing in different patterns.

Back to Crypto currency, though as a single investment item it is highly volatile (check the big swing of Bitcoin price and other coins), its correlation with stock is actually very low. Based on this point, Crypto currency is a good asset class which can diversify a portfolio mainly containing stocks.

What could be the loophole? Crypto currency is still in its early days as an investment instrument. Its long term correlation with stocks and other financial assets is still to be studied. But so far its price is not impacted by stock market. Secondly, Crypto currency is highly risky (not only supply and demand manipulation, but also regulatory risks). There are so many fishy coins out there. Investing in Crypto currency still like gambling. So you have to do your homework and manage the right assets allocation.